The fast-casual restaurant industry is booming, with recent statistics revealing its remarkable growth and immense potential for success. According to a recent report, the fast-casual segment has experienced a staggering 10% annual growth rate over the past five years, surpassing the growth of both fast food and full-service restaurants. As this sector continues to thrive, it becomes increasingly crucial for fast-casual restaurants to streamline their financial processes.

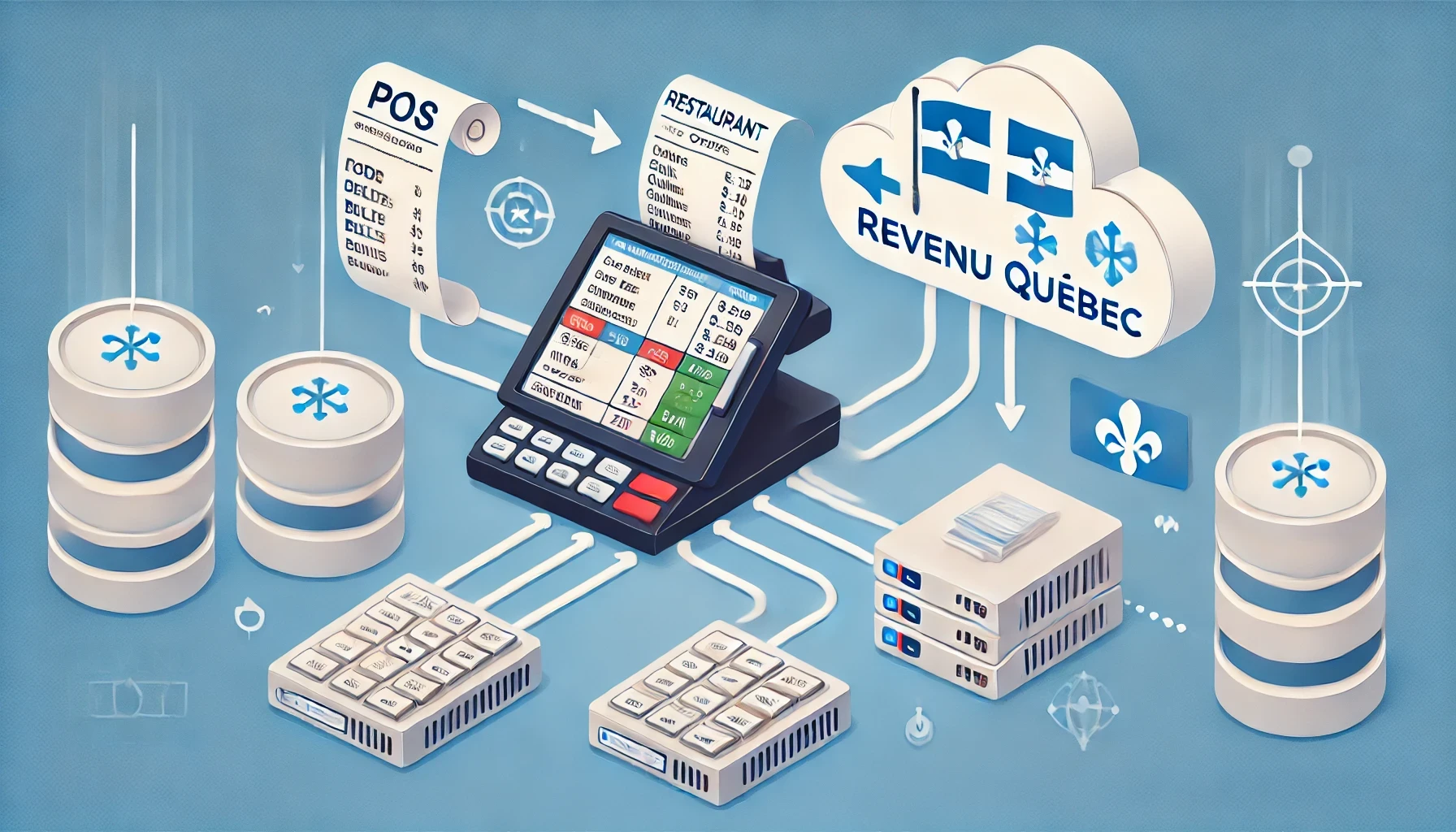

Efficient management of your restaurant’s financial data is essential for maintaining accurate records, streamlining operations, and making informed business decisions. Integrating your point of sale (POS) system with your accounting software can significantly simplify your financial processes. Let’s explore the key benefits of integrating your POS with your accounting system, highlighting the advantages it offers for fast-casual restaurants and other businesses.

Streamline Data Entry and Accuracy

By integrating your POS system with your accounting software, you eliminate the need for manual data entry, reducing the chances of human error and saving valuable time. Each transaction processed through your POS system, such as sales, refunds, and discounts, is automatically recorded in your accounting software. This seamless integration ensures that your financial data is accurate and up-to-date, allowing for efficient reconciliation and eliminating the need for duplicate entries.

Real-Time Financial Insights

Integrating your POS with your accounting system provides real-time access to vital financial insights. With the integration, you can generate comprehensive reports that give you a clear overview of your business’s financial health. These reports include sales summaries, revenue breakdowns, cost of goods sold, and profit margins. By having access to accurate and up-to-date financial information, you can make informed decisions about pricing, inventory management, and business growth strategies.

Simplify Tax Compliance and Reporting

One of the significant advantages of integrating your POS with your accounting system is the simplification of tax compliance and reporting. The integration allows for accurate tracking and categorization of sales, expenses, and taxes. When tax season arrives, your accounting system can generate detailed reports that streamline the process of filing tax returns. Additionally, integrating with accounting software like QuickBooks enables you to easily import data and synchronize financial information, reducing the likelihood of errors during tax preparation.

Integrating your POS system with your accounting software brings numerous benefits to fast-casual restaurants and other businesses. By streamlining data entry, ensuring accuracy, and providing real-time financial insights, this integration saves time, reduces errors, and enhances operational efficiency. Simplified tax compliance and reporting are additional advantages, helping you stay organized and avoid costly mistakes during tax season. Partnering with a reputable POS provider like MYR POS, which offers seamless integration with accounting software such as QuickBooks, will empower your restaurant with the tools needed to manage financial data effectively and make informed business decisions.