Buying a franchise is exciting for any entrepreneur (be they seasoned, or new to the game). It blends the independence of owning your own business with the support of an established brand. Known for providing instant brand recognition, franchises like popular restaurant chains or automotive repair centers can deliver a ready-made customer base and a robust support system for sales and marketing. This unique combination often means less time and effort is needed to turn your startup into a thriving concern compared to starting from scratch.

However, diving into the world of franchise ownership is not without its risks. It’s a venture that requires strategic planning, a keen understanding of financial structuring, and the management skills to operate effectively. While the allure of running your own business can be strong, it’s crucial to balance this dream with a pragmatic approach to financial planning and business operations.

For many aspiring franchise owners, securing the right business loan is a critical step. Whether you’re actively involved in the day-to-day running of the franchise or taking on a more hands-off investment role, understanding your financing options is key to ensuring your venture’s success. From traditional bank loans to franchisor funding and other creative financing solutions, there are various paths to securing the necessary capital.

1. Essential Questions Before Financing Your Franchise

Before you dive into the world of loans and financing, it’s crucial to ask yourself some key questions:

What’s My Budget? Consider not just the franchise fee but also other expenses like real estate lease, inventory, and payroll. Don’t forget to account for your personal expenses and a buffer for unforeseen costs.

Estimated Time to Profitability: Research and talk to existing franchisees to understand how long it might take for your business to become profitable.

Credit Score Assessment: A good credit score can significantly ease the loan process. If your credit score needs improvement, start working on it now.

Savings: Assess how much you currently have in savings. If you’re short, start planning how you can accumulate the necessary funds.

Net Worth Calculation: Your net worth is a critical factor for potential franchisors. A higher net worth indicates better financial management skills.

Exploring Financing Options: Understand the various financing options available, including franchisor funding, IRA/401(k) business financing (in the USA), lines of credit, and SBA loans.

Investor Consideration: Decide if you’re comfortable with investors and the level of control you’re willing to share.

2. Understanding Loan Expectations for First-Time Franchisees

If you’re new to franchise ownership, the loan process might seem overwhelming. Here’s what you need to know:

Financial Strength: Banks will look for evidence of your ability to repay the loan, such as cash reserves or a history of business success.

Alternate Repayment Sources: Be prepared to show that you have other means of repaying the loan, such as investments or a partner’s income.

Personal Guarantees: Lenders often require personal guarantees, making you responsible for the loan even if your business doesn’t succeed as planned.

Collateral Liens: If other forms of security are not available, lenders may require collateral in the form of liens on personal assets.

3. Exploring Different Financing Options

Securing the funds for your franchise is a critical step, and fortunately, there are multiple financing options available, each with its own set of advantages and considerations. As you begin this journey, it’s important to carefully evaluate these options to determine which aligns best with your financial situation and business goals. Here’s a closer look at some of the common financing avenues you might consider:

Franchisor Funding: Some franchisors provide in-house financing to help new franchisees get started. These options can be convenient, but it’s crucial to compare the terms and conditions offered with those of other external loans to ensure you’re getting the best deal.

Retirement Funds: When considering the financing of your franchise, tapping into retirement funds is a strategy that can be utilized in both the USA and Canada, each with its own specific types of accounts and regulations.

Canada – Accessing RRSPs: In Canada, potential franchisees can tap into Registered Retirement Savings Plans (RRSPs) for funding. While not specifically designed for business investment, programs like the Home Buyers’ Plan and Lifelong Learning Plan permit RRSP withdrawals under certain conditions without immediate tax penalties. It’s important to be aware of the repayment obligations and the impact on retirement savings, advising consultation with a financial expert to navigate these options effectively.

USA – Using Retirement Funds: In the United States, entrepreneurs can consider using funds from retirement accounts like IRAs or 401(k)s to finance their franchise. This option allows the investment of retirement savings into the business while avoiding early withdrawal penalties and immediate taxes. However, it’s crucial to understand the IRS rules and potential risks to your retirement security, making professional financial advice a key part of this decision.

Lines of Credit: Opting for a line of credit from a financial institution offers flexibility, allowing you to draw funds as needed. This can be particularly useful for managing cash flow and unexpected expenses.

SBA Loans: Loans backed by the Small Business Administration (SBA) (or Canadian equivalents) are a popular choice among franchisees due to their generally favorable terms, including lower interest rates and longer repayment periods.

4. Improving Your Net Worth

Improving your net worth is an essential step when preparing to finance a franchise. A robust net worth not only enhances your appeal to franchisors but also significantly bolsters your prospects of obtaining favorable financing. Here’s how you can work towards increasing your net worth in a practical and effective way.

Paying Down Debts: Begin by tackling your liabilities. This could mean focusing on high-interest debts first or employing strategies like the snowball or avalanche methods. Whichever approach you choose, remember that reducing your debts is one of the most effective ways to enhance your net worth. It’s not just about paying off the large debts; even chipping away at smaller loans can have a cumulative positive impact on your financial health.

Increasing Savings: Consistently setting aside money into a savings account or an investment portfolio is another key strategy. This doesn’t mean you need to make large contributions all at once. Even small, regular deposits can grow over time, thanks to the power of compound interest. Consider automating your savings to ensure a consistent and hassle-free process.

Investing Wisely: Smart investments can significantly increase your net worth. This might involve putting money into assets that are known to appreciate over time, such as real estate or stocks. However, it’s important to do thorough research or consult with a financial advisor to understand the risks and potential returns associated with different types of investments. Remember, diversification is crucial in investment – don’t put all your eggs in one basket.

Budget Management: Lastly, maintaining a tight grip on your finances through effective budget management is crucial. This involves more than just tracking your income and expenses. Analyze where your money goes each month and identify areas where you can cut back. This might be as simple as dining out less frequently or as significant as downsizing your home or car.

5. Preparing for Unforeseen Challenges

The road to franchise success is rarely smooth. Prepare for potential hurdles:

Setting Up an Emergency Fund: One of the first steps in preparing for the unexpected is to establish an emergency fund. This is a reserve of funds set aside specifically to address unforeseen business challenges. The size of this fund will depend on various factors, such as the nature of your business and your overall financial stability, but having this safety net can be the difference between weathering a storm and capsizing in it. Think of it as your financial shock absorber, cushioning the blows of sudden expenses or revenue shortfalls.

Securing Adequate Insurance: Insurance is another critical element in your defense against unforeseen challenges. This involves more than just basic coverage; it’s about ensuring that your business is protected against a range of potential risks. From general liability to property insurance, and depending on your specific franchise, specialized policies such as product liability or professional indemnity insurance may also be necessary. The right insurance not only provides financial protection but also peace of mind, allowing you to focus on running your business without the looming fear of catastrophic loss.

Developing Contingency Plans: Lastly, effective contingency planning is essential. This means having a plan B (and even a plan C) for critical aspects of your business. For instance, if you rely heavily on a particular supplier, what happens if they suddenly go out of business or can’t deliver? Or, how would you adapt if a significant market shift occurs? These plans should cover various scenarios, providing clear action steps to mitigate the impact of such events.

Final Thoughts

Financing a franchise is a significant undertaking, but with the right preparation and knowledge, it can be a rewarding process. Remember, the key to successful franchise financing is thorough research, careful planning, and a clear understanding of your financial situation and options.

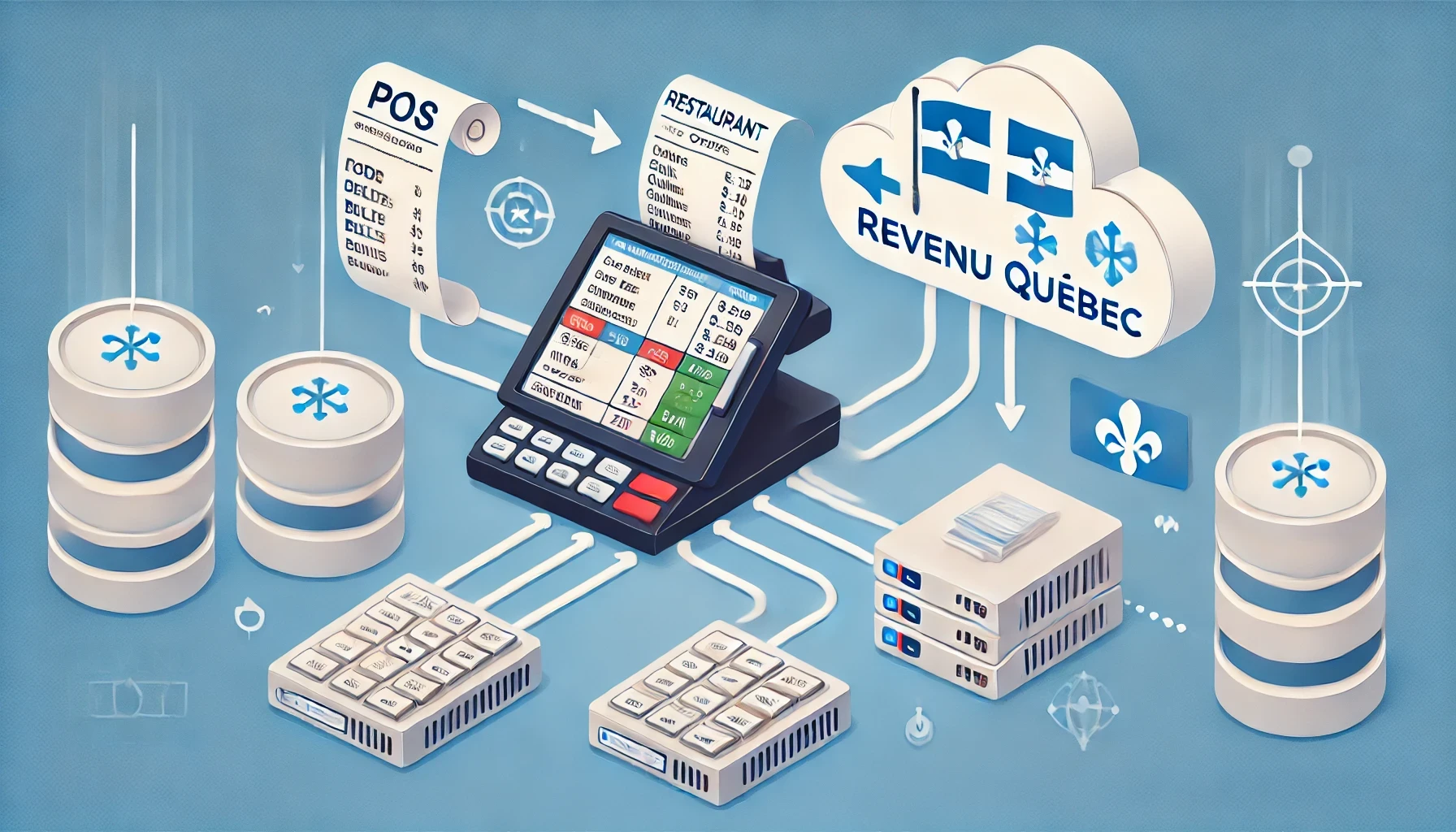

At MYR POS, our experience with a wide range of franchises has given us a real insight into what it’s like on the ground. We know that managing a franchise is about more than just numbers and contracts – it’s about the day-to-day operations and ensuring that everything runs like clockwork.

Our point of sale systems are designed to be straightforward and intuitive. This ease of use is a key advantage for franchisees, making it simpler to train staff and manage daily transactions effectively. It means less time worrying about technicalities and more time focused on delivering great service to your customers.

For franchisors, our systems offer detailed, real-time reporting. This isn’t just data – it’s a window into how each part of your franchise is performing, enabling you to provide targeted support and make informed decisions to bolster your network.

MYR POS is more than just a provider of point of sale solutions; we see ourselves as a partner in your franchising journey. We’re here to support you with tools and insights that help streamline operations and drive success. As you embark on this exciting venture, we hope this guide serves as a valuable companion, helping you realize your vision for your franchise.